BP Capital Midstream Strategy

Process

Investment Process

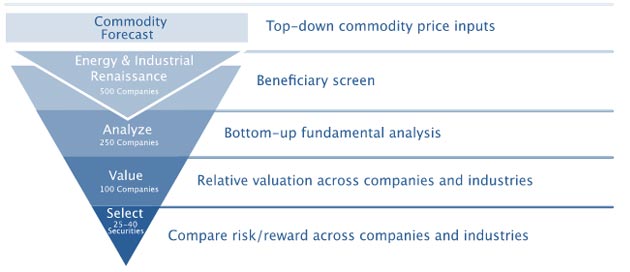

The midstream portfolio managers employ a fundamental, "boots-on-the-ground" research-intensive investment process to select holdings, focusing on four key steps:

- Develop commodity forecasts and key sector investment themes

- Identify primary beneficiaries of investment themes

- Value companies on both a relative and absolute basis to uncover potential stock mispricing opportunities

- Size position based on conviction, expected return, volatility and liquidity

Why BP Capital?

Focus

The BP Capital strategies invest in companies across the full spectrum of the energy supply-demand value chain which the Advisor believes are well-positioned to take advantage of the opportunities related to the American Energy and Industrial Renaissance.

Experience

Our energy investments gain a unique perspective (informational alpha) in the energy investment landscape from our affiliation with BP Capital, which manages commodity/energy equity hedge funds and holds private assets and mineral interests.

Insights

The BP Strategies leverage insights gained through energy sector knowledge, MLP investment experience, deep relationships and trust earned over the past 60 years to create value for Clients.